|

|

Dear Readers,

I would like to thank each and every one of the supporters of the 2016 STA Construction Awards Dinner & 50th

Anniversary Celebration. Whether you attended the event, or supported by taking a journal advertisement or sponsorship,

your contribution will help the STA continue representation of so many of New York City’s union subcontractors. The

event was an overwhelming success for the association and a poignant celebration of 50 years of service to the

construction industry.

I would especially like to give thanks to our four highly esteemed honorees: Chris Zegler of Turner Construction,

Linda Chiarelli of NYU, Christine Donaldson Boccia of J.D. Traditional Industries and Terry Moore of Local 46, Metallic

Lathers. This dinner would not have been possible without the help of our 2016 awardees.

The STA’s next General Membership Meeting will be on Thursday, June 16 at the LaGuardia Marriott in East Elmhurst,

Queens. This event will also serve as the STA Annual Meeting where the Officers and Board of Directors are elected for

the 2016-2017 term. For more information and to register for the event online, please click here. I look forward to

seeing you all on June 16.

Sincerely,

Robert J. Ansbro

STA President

By Hank Kita, STA Executive Director

With the OSHA sponsored 2016 National Fall Prevention Stand-Down scheduled for the week of May 2-7, this would seem to be an appropriate time for me to remind all of our members on the importance of safety programs at your worksites. As defined by OSHA, a “Safety Stand-Down is a voluntary event for employers to talk directly to employees about safety. The purpose of the national Stand-Down is to raise awareness so as to prevent fall hazards in construction. Contractors can conduct the Safety Stand-Down by having a toolbox talk or other safety activity such as safety equipment inspections, development of rescue plans, or just discussing job specific hazards. Nationally, falls continue to be a leading cause of death for construction workers, accounting for 345 of 899 construction fatalities in 2014.

The utility of the Fall Prevention Stand-Down in May was driven home for me by a BTEA Construction Safety Report Card event that I and other members of the STA recently attended. According to statistics provided at this event by officials of the New York City OSHA office, there were 18 construction related fatalities in the five boroughs in 2015. This is a staggering number of fatalities, most of which could have been prevented through a better adherence to routine safety standards on construction worksites. Half of the 18 fatalities were categorized as “falls”. An overwhelming majority of the fatalities (83%) took place on non-union sites. Regardless of whether the fatalities were on union or non-union sites, all were preventable.

STA members should consider participating in the OSHA Stand- Down or schedule similar safety programs and activities for their employees at various points in the year. While construction is a deadline driven, bottom line industry, the resources utilized for safety activities can only serve as an investment that assists in our employees returning safely to their families after each and every workday!

By Henry L. Goldberg, Managing Partner, Goldberg & Connolly & STA Legal Counsel

As is commonly recognized in the construction industry, the posting of a payment bond for a public improvement project

is required under Section 137 of the State Finance Law. This is obviously designed to “guarantee” payment to those

subcontractors and suppliers who provide labor and/or furnish material on a project. Payment bonds, of course, are also

often available on private sector projects. However, there are certain beneficial aspects of a payment bond that are

not as well known in the industry and there are important dates that must always be observed to preserve your payment

bonds rights.

A. Perfecting A Subcontractor’s Bond Claim – For Other Than First Tier Subcontractors

In order for a subcontractor, other than one who has a direct contract with the general contractor, to preserve its

claim under a payment bond, it must serve notice upon the contractor, by registered or certified mail of its intent.

This must be done within 120 days (on Federal “Miller Act” projects it’s 90 days) from when the subcontractor last

furnished materials or provided labor. The notice must simply state that the claimant has not been paid for over 90

days, the total amount owed, a description of the work or material and that the sub or material man is making a claim

for non-payment under the payment bond.

B. Later Suit Commencement Date For Public Projects - New Rule

Thereafter, an action to enforce a payment bond claim must be commenced in the county where the project is located,

within one-year from completion and acceptance of the project by the public owner.

This reflects an important recent change in the applicable rules. The starting time for the one-year suit limitation

period is now similar to the time period for the filing of a public improvement mechanic’s lien (although for a public

improvement mechanic’s lien, the actual last date to file is 30 days after “completion and acceptance” of the project).

In the past, the contractual limitation period began to run one-year from when the subcontractor last did work on or

provided materials to the project. This often created a question as to when this actually occurred. For earlier trades,

it also presented a risk, since the sub or supplier may have completed their efforts long before the entire project was

completed. By that later time, the period to sue under the old law (based on their own time on the site) may have

expired.

In contrast to the time to sue, as indicated above, the rule regarding initial notice by other than a first tier

subcontractors has not changed. The 120 day notice of claim requirement still begins to run from the date on which the

subcontractor, itself, last furnished labor or delivered materials. Note that warranty or repair work, generally

speaking, does not re-start the 120 day clock anew. While we have been able to convincingly use such repair or warranty

work to save certain claims under the right set of facts, risking your claim by inaction is not a best practice. Start

early.

C. Interest & Attorney’s Fees

Both of these benefits are often either over-looked or not adequately pursued. Interest is clearly available for

payment bond claims made in the public sector pursuant to State Finance Law §137. Even in the private sector you

may be entitled to pre-judgment interest as well as, of course, post judgment interest at 9%! Hold fast on your demand

for interest. It should not be the first casualty of settlement negotiations.

A second misunderstanding is that the trust fund provisions of Article 3-A only apply to public works projects. This is

also not true.

A third misunderstanding is that a trust fund beneficiary, such as a contractor, subcontractor or materialman, is only

entitled to a written verified statement of all funds received by the trustees and all funds paid out by the trustees

from those funds. However, the itemized statement of account is certainly not the beneficiary’s only option.

In addition to awarding interest from the date when the subcontractor first demanded payment, courts may also award a

contractor reasonable attorney fees whenever it appears to the court that the reasons set forth by the surety for not

paying the bond claim were without “substantial basis in law or fact.” In other words, they were merely

pretextual and the claimant, as a result, deserves to be reimbursed for its attorney’s fees for having been put

to the expense of suing the surety.

D. Bond on Private Project

While not mandatory on private projects, it is becoming more common, given the size, complexity and cost of large

development projects today, for owners or developers, or more likely, their lending institutions, to demand bonding,

despite the cost, to assure that subs and suppliers are paid.

E. Always Get a Copy of the Actual Payment Bond

In every instance where a bond is required under either a public or private improvement contract, it is essential for a

subcontractor to request that the general contractor provide a copy of the payment bond before the sub commences work.

This must be a standard operating procedure. If a copy of the bond is not readily provided upon request (and,

surprisingly, this is a rather common occurrence), the subcontractor can usually obtain a copy of the bond from either

the agency in charge of the public improvement, or the Comptroller’s Office, as both are required to maintain copies of

bonds on all public improvement projects. For private projects, this is even more critical, since the time deadlines

mentioned above can vary amongst private sector sureties, even if the standard AIA A213 Form is utilized. Also, the

contact information for the surety, and information identifying the bond, is clearly set forth on the bond.

G&C Commentary

Some would say that the foregoing is “basic,” that everyone knows of these protections. They are “bread and butter”

issues.

I beg to differ. For many of you, that may be true, but I am here to report “from the trenches” in the battle for fair

and timely payment, that poor payment practices are epidemic in the industry today and that subcontractors and

suppliers are not availing themselves of all these “well known basics.”

The STA has fought long and hard, for decades, to obtain and protect these important rights. The amendment to the State

Finance Law extending the time to commence a lawsuit enforcing a payment bond up until “completion and acceptance” of a

public project, is just a recent example.

Sometimes, fear of upsetting a business relationship causes inaction, sometimes just lack of knowledge, and sometimes

just “being too busy.” I’ve heard it all. However, these “excuses” all have the same result – a severe hurt to your

business that could have been avoided.

Remember, if these protections are all “so basic,” why are you not using them?

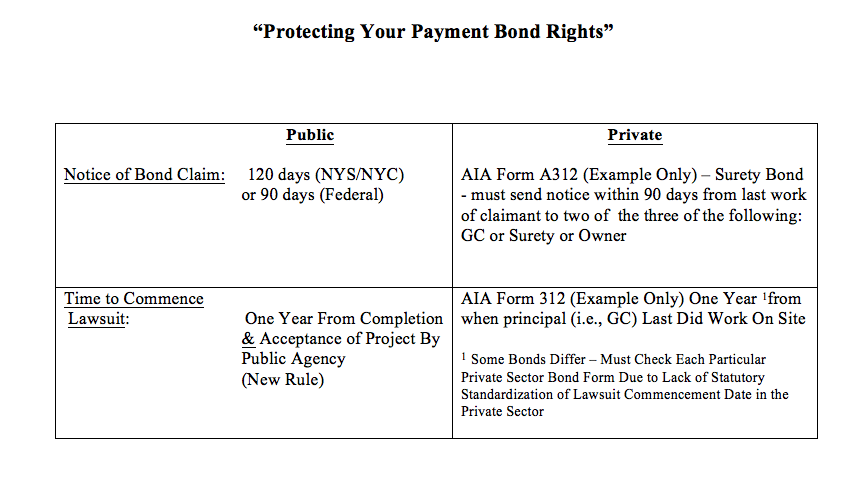

Finally, in order to help keep clear the nuanced differences discussed above among: 1. public and private projects; and

2. notices of payment bond claims, as distinguished from payment bond lawsuit commencement dates, I’ve prepared the

following chart for your convenience:

Henry L. Goldberg may be contacted by email, hlgoldberg@goldbergconnolly.com or by telephone, 516-764-2800.

Over 400 guests attended the STA’s 2016 Construction Awards Dinner & 50th Anniversary Celebration.

The awards ceremony, which was held on Wednesday, April 6 at the Pierre Hotel in Manhattan, honored four distinguished industry leaders who have significantly contributed to New York City’s skyline in the past year and beyond.

Linda Chiarelli, Vice President for Capital Projects and Facilities at NYU was presented with the Silver Shovel Award. NYU has supported many of New York City’s union subcontractors on its projects including 181 Mercer Street Community Campus and the new construction and reshaping of NYU Langone Medical Center. NYU has been one of the strongest supporters of union subcontractors in the city in recent years.

Chris Zegler, Vice President and General Manager for Turner Construction Company, received the Builder of the Year Award. Mr. Zegler oversees a diverse portfolio of projects across the metropolitan area, including Lower Westchester and Long Island. He has been with Turner since 1982, and was promoted to positions of greater responsibility in the New York Office throughout his long career there, including Project Executive, Operations Manager, and most recently Preconstruction Manager.

The Ronald Berger Subcontractor of the Year Award was presented to Christine Donaldson Boccia, Executive Manager of J.D. Traditional Industries. JDTI is a certified MWBE and union subcontracting company that specializes in drywall, acoustics, ornamental plaster and specialty ceilings, among many others. Ms. Boccia oversees all aspects of her company including accounting, estimating, project management, marketing, business development, and union & contractor relations.

Terry Moore, Business Manager and Financial Secretary Treasurer of Metallic Lathers and Reinforcing Ironworkers Local 46, was awarded the Labor Leader of the Year Award. Local 46 represents 1,500 active members and 900 retirees. Mr. Moore was an active building tradesman since the early 1980s and was elected twice to the Union’s Executive Board before being elected Business Agent in 1993, which he served as for 18 years.

In addition to honoring these distinguished industry professionals, the association was also celebrating its 50th anniversary. The STA has accomplished many great feats on behalf of union subcontractors all over the city in the past five decades, and continues to work to ensure that these companies receive the respect and recognition they deserve.

The Subcontractors Trade Association Board of Directors and Officers would like to thank all of those who attended the dinner, sponsored the event and placed advertisements in the Awards Journal for their ongoing support of the association. The STA would not be able to represent New York City’s union subcontractors without the backing of its many benefactors.

Looking to the future, the STA is launching an initiative this Spring aimed at the future of the union subcontractor community through the formation of a “Young Professionals Group”. The STA’s “Young Professionals Group” will consist of 2nd generation company owners and young management level employees of STA members, who would like to become more active in the STA, obtain exposure within the New York City construction industry, and network with other young professionals. Individuals up to the age of 39 can become members of this group.

There will be several social and professional events planned for the “Young Professionals” over the course of the year. For more information on and to join the STA’s “Young Professionals Group”, please contact STA Executive Director Hank Kita at hkita@stanyc.com or by phone at 212-398-6220.

By Joe Molloy, Grassi & Co., CPAs

Tax season for 2015 has finally wrapped. Are you wondering if you should have gotten a bigger refund or if you over paid? One of the main challenges of any construction contractor is cash flow, after all cash is king, but what many contractors aren’t aware of are little tax incentives that can yield BIG savings. Three of the most lucrative incentives are: the Section 179D tax deduction, the Research & Development (R&D) tax credit, and the Cost Segregation Study.

How does the 179D deduction work?

The 179D allows a tax deduction of a commercial building’s owner for the reduction of energy and power of lighting, heating and cooling (HVAC), and the building envelope. Once certifications and inspections are completed by a qualified engineer or contractor, and it has been confirmed that there is at least a 50% savings in energy and power costs, a deduction of up to $1.80 per square foot can be applied. If 50% is not met then savings can be broken down as follows:

• 60 cents a square foot for HVAC systems meeting 15% savings

• 60 cents a square foot for lighting systems meeting 25% savings

• 60 cents a square foot for building envelope systems meeting 10% savings

What are the benefits of 179D for architects and engineers?

Since government-building owners do not pay taxes, they are unable to benefit from the 179D incentive. However, the tax incentive may then be passed down to the designers, or those who assist designers, of the energy efficient system being utilized. In order to pass it down, the government entity needs to provide an allocation letter assigning the deduction to the designers/or contractors. The letter must state the name of all parties involved, the cost of the project, the amount of the deduction, and the year of service.

The types of buildings that qualify as government buildings are as follows: government offices, schools, state universities, transportation facilities, post offices, airports, military bases, and courthouses.

The Research and Development (R&D) Credit:

Upon hearing the term “research & development” one may conjure images of work being performed in a laboratory. The research and development (R&D) credit, in this case, is inclusive of day-to-day operations including the development of new or improved products, enhancements to existing products, or the improvement of production processes.

Qualified Research Expenses (QRE) are expenses that are paid by a taxpayer for carrying on a trade or business relating to in-house research. These are amounts paid or incurred for wages, and supplies, and/or amounts paid or incurred to another person for the right to use products in order to perform qualified research.

This past December, with the passing of the PATH (Protecting Americans Against Tax Hikes) Act, the R&D credit became permanent. This credit can also be used against Alternative Minimum Tax (AMT).

What is a Cost Segregation Study?:

One of the most lucrative incentives is a cost segregation study. Simply stated, a cost segregation study allows taxpayers to frontload depreciation expense. The process requires an engineering report that segregates assets into four categories:

1) personal property

2) land improvements

3) building components and

4) land

This method should be considered when constructing a new facility, acquiring an existing facility, or renovating an existing facility. The rules are very specific and taxpayers should consult with their accountant before moving forward. A critical step in the cost segregation process is selecting the proper engineering firm to assist with the calculation. Having the proper team in place will help ensure the study is completed within Internal Revenue Service (IRS) guidelines. You may also benefit from performing a study allowing for the correction of missed depreciation in past years.

If you weren’t aware of these tax-saving techniques it’s not too late. You can either amend your existing return, or if you are on an extended deadline you have until September 15th to incorporate these incentives or to participate in a cost seg study.

If you are unsure whether you’ve explored all tax-saving possibilities, contact Joseph Molloy of Grassi & Co. at jmolloy@grassicpas.com and receive a consultation.

Being on the STA email list ensures that you will stay up to date with industry news, association events & happenings among other benefits! Please send any additional email addresses to info@stanyc.com with the subject “STA Email List” to be added!

|

|

|

|